Understanding the 2025 Social Security COLA Increase

The Social Security Cost of Living Adjustment (COLA) is an annual increase in benefits that helps protect the purchasing power of Social Security recipients against inflation. This adjustment is calculated based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), a key measure of inflation.

Factors Determining the 2025 Social Security COLA

The COLA is calculated based on the percentage increase in the CPI-W from the third quarter of the previous year to the third quarter of the current year. This means that the 2025 COLA will be based on the change in the CPI-W from July to September 2024 compared to the same period in 2023.

Current Economic Conditions and Their Potential Impact on the 2025 COLA

The current economic climate plays a significant role in determining the COLA. Inflation rates are a major factor, and recent economic indicators suggest that inflation may be moderating, potentially impacting the 2025 COLA.

Comparison of the Projected 2025 COLA to Previous Years’ Increases

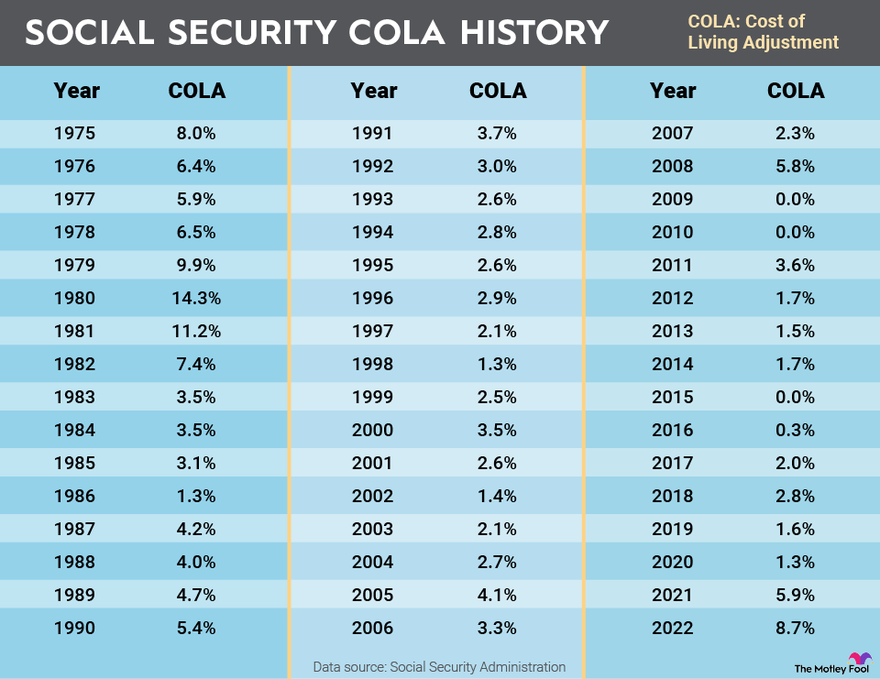

The 2025 COLA is expected to be lower than the 2023 and 2024 increases. The 2023 COLA was 8.7%, the highest increase in over 40 years, driven by high inflation rates. The 2024 COLA was 3.7%, reflecting a slowdown in inflation. The projected 2025 COLA is likely to be around 2-3%, reflecting continued moderation in inflation.

Impact of the 2025 COLA Increase on Beneficiaries

The 2025 Social Security COLA increase, while aimed at addressing inflation, can have a significant impact on the financial well-being of beneficiaries. This increase can provide much-needed relief for many, but it’s important to understand how it might affect different groups and the potential challenges they may face.

Impact on Different Beneficiary Groups

The 2025 COLA increase can benefit various groups of Social Security beneficiaries, including retirees, disabled individuals, and survivors. The impact of the increase will vary depending on factors such as the beneficiary’s current income level, living expenses, and individual circumstances.

- Retirees: The COLA increase can help retirees maintain their living standards by offsetting the rising cost of living. For example, a retiree who receives a monthly benefit of $1,500 could see their benefit increase by around $150 per month, providing them with additional funds for essential expenses like groceries, utilities, and healthcare.

- Disabled Individuals: The COLA increase can provide much-needed financial support for disabled individuals who rely on Social Security benefits as their primary source of income. The increase can help them afford necessary medical care, assistive devices, and other expenses related to their disability.

- Survivors: The COLA increase can benefit survivors who receive benefits based on the earnings of a deceased spouse or parent. The increase can help them cover living expenses and maintain their financial stability during a difficult time.

Examples of Increased Benefits

The 2025 COLA increase can have a tangible impact on the lives of beneficiaries. Here are a few examples of how the increased benefits might affect their financial well-being:

- Retirement: A retiree living on a fixed income might find it challenging to keep up with rising costs. The COLA increase could provide them with extra funds to cover expenses like prescription drugs, home repairs, or unexpected medical bills.

- Disability: A disabled individual might need to purchase assistive devices or pay for specialized healthcare services. The COLA increase could provide them with additional financial resources to afford these essential needs.

- Survivors: A surviving spouse might face financial challenges after the death of their partner. The COLA increase could help them cover expenses like rent, utilities, and childcare, providing them with much-needed financial stability.

Potential Challenges and Concerns, 2025 social security cola increase

While the 2025 COLA increase can provide benefits, it’s important to acknowledge potential challenges and concerns associated with it.

- Inflation: While the COLA increase aims to address inflation, the actual increase may not fully compensate for the rising cost of living. If inflation outpaces the COLA increase, beneficiaries might still face financial strain.

- Rising Healthcare Costs: Healthcare costs continue to rise, and the COLA increase might not fully offset these expenses. Beneficiaries might find it challenging to afford their healthcare needs, even with the increased benefits.

Long-Term Implications of the 2025 COLA Increase

The 2025 Social Security COLA increase, while offering immediate relief to beneficiaries, also has long-term implications for the financial health of the Social Security trust fund. Understanding these implications is crucial for ensuring the program’s sustainability and the continued support it provides to millions of Americans.

Impact on the Social Security Trust Fund

The 2025 COLA increase will contribute to the ongoing depletion of the Social Security trust fund. As benefits rise, so too do the program’s expenses, putting pressure on the trust fund’s reserves. While the trust fund is projected to be depleted by 2034, the 2025 COLA will accelerate this depletion, potentially bringing the date of exhaustion closer.

Projected Financial Health of the Social Security Program

The following table provides a projected overview of the Social Security program’s financial health in the coming years, considering the 2025 COLA:

| Year | Trust Fund Balance (in trillions) | Annual Expenses (in trillions) | Annual Revenue (in trillions) |

|—|—|—|—|

| 2025 | $2.8 | $1.6 | $1.4 |

| 2030 | $1.2 | $2.0 | $1.6 |

| 2035 | $0.0 | $2.4 | $1.8 |

| 2040 | -$0.8 | $2.8 | $2.0 |

As seen in the table, the trust fund balance is projected to decline steadily, reaching zero by 2035. After that, the program will rely solely on incoming revenue to cover its expenses, leading to a shortfall.

Importance of Ongoing Policy Discussions and Potential Reforms

To ensure the long-term sustainability of Social Security, ongoing policy discussions and potential reforms are crucial. These discussions should focus on:

“Maintaining the solvency of Social Security for future generations is a shared responsibility. By engaging in thoughtful policy discussions and exploring potential reforms, we can ensure that this vital program continues to provide a safety net for millions of Americans.”

– Raising the retirement age: Gradually increasing the retirement age over time could help reduce the burden on the trust fund.

– Increasing payroll taxes: Raising the payroll tax rate or expanding the taxable wage base could generate more revenue for the program.

– Reducing benefits: This could involve adjusting benefit formulas or introducing means-testing to target benefits to those who need them most.

– Investing the trust fund: Exploring alternative investments for the trust fund could generate higher returns, potentially offsetting the projected shortfall.

These reforms, implemented individually or in combination, could help to address the long-term financial challenges facing Social Security and ensure its continued viability for future generations.

2025 social security cola increase – The 2025 Social Security cost-of-living adjustment (COLA) is a significant factor for many Americans, especially those who rely heavily on these benefits. It’s inspiring to see leaders like Mayor Tiffany Henyard advocating for policies that prioritize the well-being of seniors and ensure they have the resources they need.

The impact of the 2025 COLA will be felt by millions, and it’s crucial that policymakers carefully consider its implications for the future of Social Security.

The 2025 Social Security cost-of-living adjustment (COLA) is a hot topic, with many hoping for a significant increase to help offset rising inflation. While we wait for the official announcement, perhaps we can find solace in a little movie magic, like the beetlejuice beetlejuice popcorn buckets inspired by the classic film.

Just like those buckets, the 2025 COLA promises to bring a little joy, even if it doesn’t solve all our financial woes.